Monday, February 12, 2024

SPX Maximum Self-Assembly Lammert Fractal Growth: X/2.5X/2.5X :: 35/86/88 Weeks - March 2020 to 12/13 February 2024

March 2020 Peak Lammert Fractal Growth and the Great 1982 13/31-32 Year Crash

From March 2020 the fractal math for the maximum time based self-assembly fractal growth for equities is quite simple : X/2.5X/2.5X , where X is the time length of the First Fractal Base ending in a low valuation (30 October 2020), 2.5X is the time length of the Second Fractal ending in a low valuation (16/17 June 2022), and 2.5X is the time length of the Third Fractal ending in a peak valuation. (12/13 February 2024)

First Fractal: X: 35 weeks: 23 March 2020 to 30 October 2020

(3)/33 weeks {the first 3 weeks (3) represent preceding terminal decay}

X is the time length of the First Fractal with all intervening daily/weekly valuations above the valuations of the first and last time unit (day or week) of the First Fractal Base grouping. Because growth begins in decay, the First Fractal Base X includes 3 weeks of a preceding decay series. This 3 week grouping serves as base subfractal for (3)/6/7/5 week subfractal growth series within the First Fractal Base. (see above figure)

Second Fractal: 2.5X: 86 weeks 30 October 2020 to 16/17 June 2022

The Second Fractal is the most characteristic Fractal unit and is defined by an observable nonlinear gap lower low valuation between 2X and 2.5X. See the 2005 opening page of The Economic Fractalist website. This occurs between week 85 and 86. (see above figure)

Third Fractal: 2.5X: 88 Weeks 16/17 June 2022 to 12/13 February 2024

The Third 88 week 2.5X Fractal was completed on 12/13 February 2024 and was concluded with a daily Lammert fractal growth series starting 27 October 2023. (below image)

The concluding 27 October 2023 self assembly growth fractal series is composed of a 16/33/26 day fractal series. In this case the Second Fractal of 33 days days determines the ideal length of the first base fractal as 13 days (33 divided by 2.5) The Third Fractal of 2X or 2 times 13 is 26 days occurring on 12 February 2024. The SPX made a new high on 12 February 2024 and ended near the low of the trading day.

A hard landing is coming for the global economy with an expected global equity low valuation in January/February 2025.

Sunday, January 21, 2024

The Great 1982 13/31 of 31-32 Year Second Fractal 2024-25 US Wilshire Crash

As part of a 1807 US hegemony x/2.5x/2.5x/1.5x :: 36/90/90/54 year great fractal progression with nadirs in 1842/43 and 1932, and a peak valuation in November 2021, the valuation of the US progenitor and composite Wilshire has risen with post World War II US global money/credit expansion and with initially its enormous geopolitical and manufacturing dominance. Since the Volcker US peak interest rates in 1982, the Wilshire has been propelled by money and debt expansion from both the gradual 45 year lowering of US (and global) interest rates and later from direct central bank creation and ownership of debt and 2020 MBS’s and from historically low corporate and private debt interest rates tied to near zero fed funds rates whose combined QE effect fueled the post Covid equity boom.

While the US 3 month Treasury minus Ten Year Note has been inverted to a depth and monthly duration similar to the pre1929 equity crash, the SPX, ( but not the Wilshire which includes small cap equities), has peaked on 19 January 2024 to a new high. It is both the combination of end phase creation of service-based economy jobs associated with new debt creation and money dis-proportionally pouring into the SPX’s big 7 tech companies which have supported the SPX’s recent bubble peak valuation.

The 1807 36 year Wilshire progenitor First Fractal ended in 1842/43. The 90 year Second Fractal peaked in 1929 and nadir-ed in 1932. The 90 year 8 July 1932 Wilshire composite Third Fractal peaked on 8 November 2021 with a 54 year 4th Fractal expected to end in 2074.

The US 90 year Third Fractal and 54 year Third Fractal are composed of two interpolated sub-series: a 51 year fractal sub-series 1932 to 1982 of 10-11/22/21 years and a 1982 13/31-32/31-32/18-20 year fractal series ending in 2074.

The graphs below show the quarterly fractal progression from 1982 of 49/120 of 123-5 quarters.

The monthly progression from March 2020 is 8-9/21/20 of 20-21/12-13 months :: x/2.5x/2.5x/1.5-1.6x

Sunday, November 19, 2023

NEW TARGET FOR GLOBAL CRASH LOW: 8 DECEMBER 2023

US long term debt instruments reached an inter-day low of 0.4 pc on 9 March 2020 and have risen to a high of 4.997 pc on 23 October 2023. The US central bank is simply allowing supply and demand market forces to apply QT to an overheated economy fueled by printed money, 2 plus trillion dollars of covid savings, and covid forbearance of payments on US MBS related mortgages and US-lended college debt. Covid savings and easy forbearances on debt payments are expiring or have expired. Outstanding credit card debt, subprime automobile debt, and student loan debt make it difficult for further private debt expansion for the masses in the US consumer based economy.

The current fractal pattern of the US Ten Year Note interest rates, in conjunction with the monthly, weekly, and daily fractal patterns of global equity, gold, commodity, and cryptocurrencies provide predictive guidance for the 2023 interim crash low for the non-debt asset entities.

After completing a March 2020, 7/16/17 month :: x/2-2.5x/2-2.5x fractal growth series, US Ten Year interest rates have self ordered into an observable 2/4/4 month fractal growth pattern. On a weekly basis this 2/4/4 month growth fractal is composed of two fractal series: 5/12/7 weeks :: x/2.5x/1.5x and 3/8/3 of 6 weeks :: x/2.5x/2x. The daily fractal series from 5 April 2023 is 21/52/32 days correlating to the 5/12/7 week fractal series and 14/32/ 11 of 25 to 26 days correlating to the 3/8/3 of 6 week fractal growth series. The daily fractal series for US Ten Year Note interest rates are depicted in the image below.

The beginning nadir month of a monthly fractal series contains 4 weeks in it and the beginning nadir week of a weekly fractal series contains 5 days which must be added to the daily subfractal (1) series. For the SPX , 5 down days in the first weekly is added to the 52 day 13 March 2023 to 24 May 2023 subfractal (1) for a total of 56 days {56 vice 57 days because the fifth day of the 5 days contained in the first week down is same as the first day of the subsequent 52 day subfractal(1) series). 8 December 2023 would complete a 56/139 day :: x/2-2.5x subfractal(1) and subfractal (2)series. If the final lower high for the US Ten year note was on day 26 of a 14/32/26 day series 11 December 2023, would complete a 56/140 day series.

Bitcoin in USD final daily series(trading 7 days a week) appears to be self-assembled into an 11 October 2023 10/25/25 day fractal series ending on 8 December 2023. Ford is appears to be self-ordered as a 24 May 2023 19/47/47/14 of 28 to 29 day :: x/2.5x/2.5x/1.5x fractal series ending 8 December or 11 December 2023.

Wednesday, November 15, 2023

New Target Date for November 2023 crash low: 29 November 2023 day 130 of a 13 March 2023 52/130 day :: x/2.5x fractal series

The 14 day valuation gain from the 27 October 2023 low was unexpected but within the 13 March 2023 52 /104 to 130 day :: x/2x-2.5x nonlinear window. Qualitatively, the dominant service sector US economy has an operational consumer population that has no savings and has the highest ever collective debt at the highest interest rates in over 15 years. The consumer is tapped out. The Chinese economy whose base population savings is in real estate has a different, but real problem with the collapse of property and real estate prices and a collapse of stock valuations of the large corporations, e.g., Evergrande and Country Garden who build residential properties and are currently defaulting on interest debt payments. With collapsing Chinese property values (and equivalent savings), decreased foreign consumption demand because of foreign consumer debt load, and decreased domestic demand because of lost savings, the Chinese economy is near the threshold of significant retrenchment. The Bank of Shanghai, a proxy for the Chinese macroeconomic system, appears to be following a July 2021 35/85 of 87/70 week :: x/2.5x/2x fractal decay series with a subfractal (2) 87 week expected low at the end of November 2023.

The 13 March 2023 to 29 November 2023 52/121 of 130 day :: x/2.5sx fractal series is depicted below with the current 14 day gain part of a 26 September 2023 7/18/14/1 of 10 day fractal decay series.

Sunday, November 12, 2023

Lammert Saturation Asset-Debt Macroeconomics: The Current November 2023 Crash Low Valuation for … the Wilshire Composite, the Bank of Shanghai, Oil, Gold, and Crypto is … 21 November 2023

All of the above asset classes - and the inverse for sovereign debt interests, i.e., interest rates have a major interim low ending 21 November 2023.

Will the crash devaluation for the above assets be 5, 10, 15, 20, 25%. or more from their current Sunday 12 November 2023 valuations? Time will tell. The Bank of Shanghai should have a 25-30 percent loss from its current valuation.

The asset-debt macroeconomic system, a product of human transaction self-orders the timing of its asset classes’ peak and secondary peak high and nadir low valuations and does in a mathematical fractal pattern just as the universe self orders its parts into structures at different size and time scales: with interaction of subatomic wave-particles; atomic elements; complex molecular organic chemicals; living cells, organelles and tissue within organisms; planetary, comet, and debris interactions within star systems, those systems and black holes within galaxies, and galaxies within the universe.

Underlying the self-assembly of the subcomponents within the size and time scales are the observed elegantly simple mathematical relationships and constants that allow reasonable predictions to be made about the past, ongoing and future interactions at the particular scale.

And so, for buying and selling human transactions of the Asset-Debt Macroeconomic System, more recently strongly influenced by central bank broad QE and QT, elegantly simple mathematical time-based fractal patterns are observed for the system’s self ordering of its asset classes high and nadir valuations.

There are only two time-based self-ordering fractal patterns: a three phase fractal pattern of x/2-2.5x/1.5-2.5x and a 4 phase fractal pattern of x/2-2.5x/2-2.5x/1.5-1.6x. Subfractal (3) 2-2.5x of the 4 phase fractal pattern can be a peak valuation in an asset=debt system whose worth is expanding such as the subfractal (3) 90 year peak valuation on 8 November 2021 of a US 1807 36/90/90/54 :: x/2.5x/2.5x/1.5 or it can be a low in system which is undergoing fractal decay which is the current Nov 2023 case with severe QT following in March 2022 after unprecedented QE in 2020.

Using quantum time based fractal progression using the two elegantly simple fractal laws of the asset-debt macroeconomic system listed above, the interim crash low for the Wilshire Composite, the Bank of Shanghai, Oil, Gold, and Crypto is predicted to be 21 November 2023 while the interim low long term sovereign interest rate(higher valuations for previously purchased US Notes and Bonds) is predicted to be 21 November 2023.

The below asset class images and their observed and predicted fractal time progression speak for themselves.

Thursday, November 2, 2023

THE GREAT NOVEMBER 2023 GLOBAL CRASH

The current fractal target date for the global intermediate crash low for equities, crypto, gold and commodities is 14 November 2023. This intermediate target date is based on two sequential monthly declining Bank of Shanghai equity 3-phase Lammert decay fractal series starting November 2017: 9/20/18 months and 9/21 of 21/12-18 months. A 27 June 2023 daily 4-phase Lammert fractal series of 14/34/28/21 days (ending 14 November 2023 ) completes a July 2021 9/21 month subfractal (1) and subfractal (2) series of a projected 9/21/12-18 month 3 phase decay fractal series.

With its collapsing overproduced by 100 % and grossly overvalued property sector, China has the overproduced and overproduced manufacturing position that the the United Staes had in 1929.

Lammert Fractals are deterministically self-ordered in the most elegantly efficient manner by the global asset-debt macroeconomic system and have two simple mathematical fractal grouping patterns: a 3-phase time-based fractal pattern of x/2-2.5x/1.5-2.5x and a 4-phase time-base fractal pattern of x/2-2.5x/2-2.5x/1.5-1.6x. Self similar fractal time units can be in minutes, hours, days, weeks, months and years. The 2-2.5x subfractal (3) of the 4-phase fractal pattern can be a peak such as the 90 year 8 November 2021 peak for the US 1807 36/90/90/54 year great fractal series or a nadir in a declining series. The fractal groupings are determined by the underlying trend line from the first and last time unit of the fractal grouping which means that the nadir valuations determine fractal groupings. the nadir valuation point for the 90 year subfractal (2) of the 1807 36/90/90/54 year Lammert 4-phase great US fractal series occurred on 8 July 1932.

On 2 November 2023, selling and buying were conducted by the “smartest” speculators or AI programs. Equities were sold to those occupying the last musical chairs with gapped higher highs on 1 and 2 November. Conversely for the smart sellers of equities, long term US Notes and Bonds were purchased with exiting equity money with a gapped nonlinear low for Notes and Bonds on 2 November 2023 which was the trading day after the completion of a 31 August 2023 9/20/16 day lower high peak interest rate and an 11 October 2023 16 day subfractal (3) 3/8/7 day lower high peak interest rate. A gapped low occurred on day 17 of the 11 October subfractal (3) ending 2.5% lower of a projected 25 day lower low interest rate series.

Updated 5 November 2023: A new fractal target for low valuation date for the global equity, gold, oil, crypto crash is 16 November 2023. Money exiting equities et. al. will flow into US longterm debt instruments driving interest rates lower.

Gold, crypto, oil, the Shanghai property index, and the linked Bank of Shanghai all have expected lows on 16 November 2023.

Tuesday, October 24, 2023

Lammert Saturation Self Assembly Saturation Macroeconomics:Peak US Sovereign Interest Rates: 19-20 October 2023; Equities, Commodities,Gold Crash low: 2 November 2023

Within the 1807 US Hegemonic self-ordering Great 4-phase Fractal Series of 36/90/90/54 years ::x/2.5x/2.5x/1.5x with its 36 year subfractal (1) low in 1842-43; its 90 year subfractal(2) low on 8 July 1932, its 90 year subfractal (3) high on 8 November 2021 - an interpolated subfractal (1) and subfractal (2) of a 13/30 year fractal series began on 11-12 August of 1982.

At the terminal portion of the 30 year subfractal (2) an interpolated monthly fractal series began in March 2020 with Covid QE near zero interest rates and massive money infusion and distribution. After a most austere central bank QT secondary to consumer price inflation, the fractal series has completed its x/2.5x/2-2.5x growth at 8/20/17 months.

The final 3/6 month fractal series of the 17 month subfractal (3) is composed of a 13 March 2023 52/104-130 day subfractal(1) and subfractal (2) series ::x/2-2.5x. Today 25 October 2023(before trading Subfractal (2)has completed day 106 and is witin the 2x to 2.5x window of nonlinearity that 104 to 130.

Lammert subfractal (2) asset valuation nonlinearity can occur with the 26-32 year and 104-130 day subfractal (2)'s windows of the 11-12 August 1982 and 13 March 2023subfractal(1) and subfractal(20 respective series.

Within the last half of the 104 to 130 day subfractal (2), two sequential 4-hour unit 3 phase decay fractal series are identfied. Starting 130PM EST 18 October 2023 Subfractal(2) is expected to nonlinearly decline in 4/10/10 4-hour unit :: x/2.5x/2.5x fractal decay pattern completing subfractal (2) on the 113th day. ie. 2 November 2023.

All asset classes will undergo synchronous nonlinear devaluation to 2 November 2023 except held sovereign US debt which will rise in value (lower interest rates).

A 20/44/44 month :: x/2-2.5x/2-2.5x growth fractal series for Bitcoin in USD that started in January 2015 with a final lower high gapped peak on 24 October 2023 will undergo a crash devaluation. Cryptocurrencies (use GBTC as a proxy) have undergone a 26 September 2023 short squeeze blow-off of 4/10/8 days :: x/2.5x/2x with a gapped high today and likely ending on the low of the day. This blow-off series will convert to a crash devaluation series of 4/10/10/6 days. The final 6th day of this crypto fractal series is 2 November 2023 and coincides with the expected terminal day of a weekly 29 Sept 2021 gold fractal series of 15/38/37/22 weeks :: x/2.5x/2.5x/1.5x with the final 22 weeks composed of a 7 June 2023 15/37/33/22 days :: x/2.5x/2-2.5x/1.5x ending on 2 November 2023.

A Primer on the the Self-Assembly Time-scale Fractal Nature of the growth and decay of asset valuations within the deterministic asset-debt macroeconomic system:

There are only two elegantly simple laws of self-assembly time-based fractal asset-debt macroeconomics:

While money and credit growth (and contraction)by central banks and government spending is periodically irregular, the global asset-debt macroeconomic system intrinsically and deterministically sets the order (self-orders) the growth and decay of the ongoing valutions of its asset classes of equity and commodity and debt composites by only two distinct time-based fractal patterns(mathematical laws): a three phase pattern: composed of three subfractals:1/2/and 3 in the time-scaled mathematical fractal order of x/2-2.5x/1.5-2.5x – where x is the base first fractal (subfractal (1) whose self-similar time length in quatified in days, weeks, months, and years.

and a four phase pattern: composed of 4 subfractals: 1/2/3/ and 4 of the mathematical fractal pattern of x/2-2.5x/2-2.5x/1.5-1.6x, where x is the base first fractal {subfractal (1)} time length in days, weeks, months, and years. Subfractal(3) of the 4 phase fractal series pattern can be a peak valuation such as the 2.5x 90 year subfractal (3) on 8 November 2021 or a low valuation in a declining fractal series.

The time length of subfractal 2 (2-2.5x) of the 3 and 4 phase fractal series often determines the ideal time length of subfractal 1 : (x’) upon which the lengths of sub-fractals 3 and 4 are based: e.g., the 4 phase fractal pattern’s time lengths become x/(2-2.5x divided by 2.5 = x’)/2-2.5x’/1.5-1.6x’.

Above is the French stock market composite CAC's fractal pathway to the 2 Novemmer 2023 crash low.

Added 940 AM EST 26 October.

A History of October 1987 Quantum Fractal Series:

The 1987 SPX and global crash occurred in the subfractal (2) 2-2.5x nonlinear devaluation widow of two interpolated

subfractal (1) and. subfractal (2) monthly fractal series. The first was a 20/45 of 46 months fractal series starting in July 1982 and the second an interpolated fractal series of 11/26 of 27 months fractal starting in November 1984.

Preceding the Sept-Oct 3 phase daily crash fractal series was a self-ordered 20 May 1987 4-phase 13/32/25/18 day :: x/2.5x/2x/1.5x fractal series ending 21 September 1987. The 4/9/10 day :: x/2-2.5x/2.5x 3-phase crash series occurred from 21 September to 19 October 1987 with a peak to nadir loss of 33%.

The SPX is again in the terminal 2x-2.5x nonlinear devaluation window of two subfractal(1) and subfractal (2)series: a 1982 13/30 year fractal series and a 13 March 2023 52/107 day fractal series. The crash daily decay fractal series appears to be a 27 September to 2 November 2023 5/12/12 day :: x/2-2.5x/2-2.5x series. At a 4-hour unit level the last 12 days appear to be following a 4/10/10 4-hour unit :: x/2.5x/2.5x 3-phase fractal decay series ideally ending around noon on the trading day of 2 November 2023. The greatest decline will likely occur in the last units of the final 10-unit sequence.

Below: Added 29 October 835 PM EST

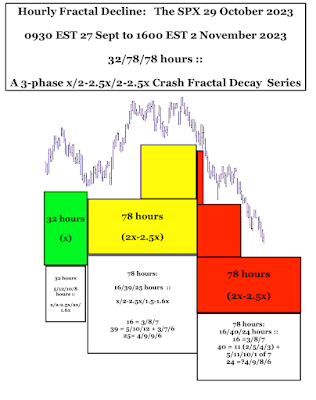

The 27 September 2023 32/78/78 hour :: x/2.5x/2.5x 3-phase fractal decay crash to the end of the trading day 2 November 2023

The final daily fractal decay sequence of a 13 March 2023 52/113 day :: subfractal (1) and subfractal (2) is a 3-phase series of 5+/12/12 days beginning on 27 Sept and ending 2 November 2023 (assuming no trading halts). On a hourly basis a 32.78/78 hour, 3- phase X/2.5x/2.5x decay fractal series is observed starting 0930 EST on 27 September 2023 and ending 400PM EST 2 November 2023.

Added 29 October 2023: 838 EST The Global banking crash. Deutsche Bank.

Subscribe to:

Posts (Atom)