Tuesday, October 24, 2023

Lammert Saturation Self Assembly Saturation Macroeconomics:Peak US Sovereign Interest Rates: 19-20 October 2023; Equities, Commodities,Gold Crash low: 2 November 2023

Within the 1807 US Hegemonic self-ordering Great 4-phase Fractal Series of 36/90/90/54 years ::x/2.5x/2.5x/1.5x with its 36 year subfractal (1) low in 1842-43; its 90 year subfractal(2) low on 8 July 1932, its 90 year subfractal (3) high on 8 November 2021 - an interpolated subfractal (1) and subfractal (2) of a 13/30 year fractal series began on 11-12 August of 1982.

At the terminal portion of the 30 year subfractal (2) an interpolated monthly fractal series began in March 2020 with Covid QE near zero interest rates and massive money infusion and distribution. After a most austere central bank QT secondary to consumer price inflation, the fractal series has completed its x/2.5x/2-2.5x growth at 8/20/17 months.

The final 3/6 month fractal series of the 17 month subfractal (3) is composed of a 13 March 2023 52/104-130 day subfractal(1) and subfractal (2) series ::x/2-2.5x. Today 25 October 2023(before trading Subfractal (2)has completed day 106 and is witin the 2x to 2.5x window of nonlinearity that 104 to 130.

Lammert subfractal (2) asset valuation nonlinearity can occur with the 26-32 year and 104-130 day subfractal (2)'s windows of the 11-12 August 1982 and 13 March 2023subfractal(1) and subfractal(20 respective series.

Within the last half of the 104 to 130 day subfractal (2), two sequential 4-hour unit 3 phase decay fractal series are identfied. Starting 130PM EST 18 October 2023 Subfractal(2) is expected to nonlinearly decline in 4/10/10 4-hour unit :: x/2.5x/2.5x fractal decay pattern completing subfractal (2) on the 113th day. ie. 2 November 2023.

All asset classes will undergo synchronous nonlinear devaluation to 2 November 2023 except held sovereign US debt which will rise in value (lower interest rates).

A 20/44/44 month :: x/2-2.5x/2-2.5x growth fractal series for Bitcoin in USD that started in January 2015 with a final lower high gapped peak on 24 October 2023 will undergo a crash devaluation. Cryptocurrencies (use GBTC as a proxy) have undergone a 26 September 2023 short squeeze blow-off of 4/10/8 days :: x/2.5x/2x with a gapped high today and likely ending on the low of the day. This blow-off series will convert to a crash devaluation series of 4/10/10/6 days. The final 6th day of this crypto fractal series is 2 November 2023 and coincides with the expected terminal day of a weekly 29 Sept 2021 gold fractal series of 15/38/37/22 weeks :: x/2.5x/2.5x/1.5x with the final 22 weeks composed of a 7 June 2023 15/37/33/22 days :: x/2.5x/2-2.5x/1.5x ending on 2 November 2023.

A Primer on the the Self-Assembly Time-scale Fractal Nature of the growth and decay of asset valuations within the deterministic asset-debt macroeconomic system:

There are only two elegantly simple laws of self-assembly time-based fractal asset-debt macroeconomics:

While money and credit growth (and contraction)by central banks and government spending is periodically irregular, the global asset-debt macroeconomic system intrinsically and deterministically sets the order (self-orders) the growth and decay of the ongoing valutions of its asset classes of equity and commodity and debt composites by only two distinct time-based fractal patterns(mathematical laws): a three phase pattern: composed of three subfractals:1/2/and 3 in the time-scaled mathematical fractal order of x/2-2.5x/1.5-2.5x – where x is the base first fractal (subfractal (1) whose self-similar time length in quatified in days, weeks, months, and years.

and a four phase pattern: composed of 4 subfractals: 1/2/3/ and 4 of the mathematical fractal pattern of x/2-2.5x/2-2.5x/1.5-1.6x, where x is the base first fractal {subfractal (1)} time length in days, weeks, months, and years. Subfractal(3) of the 4 phase fractal series pattern can be a peak valuation such as the 2.5x 90 year subfractal (3) on 8 November 2021 or a low valuation in a declining fractal series.

The time length of subfractal 2 (2-2.5x) of the 3 and 4 phase fractal series often determines the ideal time length of subfractal 1 : (x’) upon which the lengths of sub-fractals 3 and 4 are based: e.g., the 4 phase fractal pattern’s time lengths become x/(2-2.5x divided by 2.5 = x’)/2-2.5x’/1.5-1.6x’.

Above is the French stock market composite CAC's fractal pathway to the 2 Novemmer 2023 crash low.

Added 940 AM EST 26 October.

A History of October 1987 Quantum Fractal Series:

The 1987 SPX and global crash occurred in the subfractal (2) 2-2.5x nonlinear devaluation widow of two interpolated

subfractal (1) and. subfractal (2) monthly fractal series. The first was a 20/45 of 46 months fractal series starting in July 1982 and the second an interpolated fractal series of 11/26 of 27 months fractal starting in November 1984.

Preceding the Sept-Oct 3 phase daily crash fractal series was a self-ordered 20 May 1987 4-phase 13/32/25/18 day :: x/2.5x/2x/1.5x fractal series ending 21 September 1987. The 4/9/10 day :: x/2-2.5x/2.5x 3-phase crash series occurred from 21 September to 19 October 1987 with a peak to nadir loss of 33%.

The SPX is again in the terminal 2x-2.5x nonlinear devaluation window of two subfractal(1) and subfractal (2)series: a 1982 13/30 year fractal series and a 13 March 2023 52/107 day fractal series. The crash daily decay fractal series appears to be a 27 September to 2 November 2023 5/12/12 day :: x/2-2.5x/2-2.5x series. At a 4-hour unit level the last 12 days appear to be following a 4/10/10 4-hour unit :: x/2.5x/2.5x 3-phase fractal decay series ideally ending around noon on the trading day of 2 November 2023. The greatest decline will likely occur in the last units of the final 10-unit sequence.

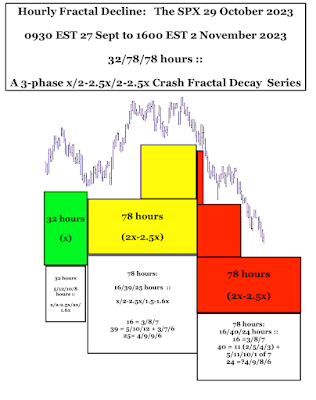

Below: Added 29 October 835 PM EST

The 27 September 2023 32/78/78 hour :: x/2.5x/2.5x 3-phase fractal decay crash to the end of the trading day 2 November 2023

The final daily fractal decay sequence of a 13 March 2023 52/113 day :: subfractal (1) and subfractal (2) is a 3-phase series of 5+/12/12 days beginning on 27 Sept and ending 2 November 2023 (assuming no trading halts). On a hourly basis a 32.78/78 hour, 3- phase X/2.5x/2.5x decay fractal series is observed starting 0930 EST on 27 September 2023 and ending 400PM EST 2 November 2023.

Added 29 October 2023: 838 EST The Global banking crash. Deutsche Bank.

Wednesday, October 11, 2023

Lammert Asset-Debt Quantum Fractal Saturation Macroeconomics: 6 October 2023 US Bond Interest Rate Peak; 31 October 2023 Wilshire Crash Low

A PRIMER ON LAMMERT QUANTUM FRACTAL GROWTH AND DECAY IN THE WORLD 1.3-1.5 QUADRILLION DOLLAR EQUIVALENT ASSET DEBT SYSTEM.

The beginning and ending boundaries of time based fractal series are defined by uptrend and downtrend lines with positive and negative slopes, respectively, that are formed by connecting the two low points at the beginning and the end of the fractal series.

In a bar chart, unit bars can be minutes, hours, days, weeks, months, and years. It is the hypothesis of this website that the asset debt macroeconomic system is deterministic and the growth and decay of the ongoing unit time valuations of its asset classes automatically self assembly in the most efficient manner with self similar fractal patterns of the unit time based bars.

There are only two elegantly simple laws of self-assembly time-based fractal asset-debt valuation growth and decay macroeconomics:

While money and credit growth (and contraction)by central banks and government spending is periodically irregular, equity and commodity composite valuations grow and decay by only two distinct time-based fractal patterns(mathematical laws):

a three phase pattern: composed of three subfractals:1/2/ and 3 :: x/2-2.5x/1.5-2.5x – where x is the base first fractal time length in days, weeks, months, and years.

and a four phase pattern: composed of 4 subfractals: 1/2/3/ and 4 :: x/2-2.5x/2-2.5x/1.5-1.6x, where x is the base first fractal time length in days, weeks, months, and years. In a four phase fractal series the sum of the length of subfractal 1 and 2 may be exceeded by the sum of the length of subfractal 3 and 4 by 0.1x.

The time length of subfractal 2 (2-2.5x) of the 3 and 4 phase fractal series often determines the ideal time length of subfractal 1 : (x’) upon which the lengths of sub-fractals 3 and 4 are based: e.g., the 4 phase fractal pattern’s time lengths become x/(2-2.5x divided by 2.5 = x’)/2-2.5x’/1.5-1.6x’.

The US Hegemony macroeconomic system is following an 1807 4 phase fractal series of 36/90/90/54 years with a 90 year Subfractal 3 high on 8 November 2021 for for the Wilshire and Bitcoin/USD. Smaller unit time based fractal series make up the 36,90,90 and upcoming 54 years.

8 November 2021 represented the peak valuation for the US (then) 48.95 trillion dollar Wilshire equity index composite.While this date was not prospectively predicted by fractal analysis for the self-assembly asset-debt system,it represented a x/2x/2x :: 31/62-63/62-63 monthly growth from the March 2009 low and a 36/90/90 year :: x/2.5x/2.5x growth from the US hegemony low starting in 1807.

Interest rates for US sovereign long term Notes and Bonds have been declining in a cascading manner since the Volcker peak of September 1981 with a series of lower high interests preceded by lower lows.The last cycle starting at its low for the US Bond market began in December 2008 at 2.61% after the 3 October 2008 Emergency Stabilization Act and the preceding housing bubble induced Lehman Brother’s implosion. The US 30 year Bond’s cascadingly lower highs and lower low interest rates were propelled by post 2009 QE programs and post covid MBS’s and resulted in another lower low in April 2021 at 1.17%. With covid checks exceeding annual wages and resulting in 2 trillion dollars of savings and with low MBS mortgage rates of less than 3.5 % (and significantly less for the Blackstone-like financial industry mortgage acquirers), the new credit and money resulting inflation caused blow-off fractal growth of interest rates with a peak 30 Bond interest rate of 5.053% occurring on 6 October 2023.

Do Debt Market valuation follow Lammert quantum fractal patterns?

The following monthly, weekly, daily fractal series represent Bond interest rate growth rather than previously purchased bonds’ ongoing converse valuation decay. These two entities are the (near exact) inverse mirror valuations of each other. Bonds purchased in April 2021 at a 1.17% yield are, as of 6 October 2023, currently worth only about 22 – 24% of their purchase value.

Do US Bond interest rates undergo the Asset-Debt macroeconomic system’s quantum fractal self-assembly?

Since the March April 2020 low, 30 Year US Bond interest rate growth has occurred in two monthly fractal series: 7/16/16 months and 2/4/4 months reaching its peak on 6 October 2023. The last 2/4/4 fractal series . represents a blow-off x/2x/2x growth fractal series.

The final 2/4/4 month fractal series starting 6 April 2023 is a 5/12/12 week series ending 6 October 2023.

Three Blow-off higher high exhaustion gaps occur in the terminal 13 days

The final 12 weeks of the 5/12/12 week series starts on 19 July 2023 and is self assembled into three Lammert fractal series: a 4 phase series of 5/12/10/8 days :: x/2.5x/2x/1.6x; a three phase series of 3/7/6 days :: x/2-2.5x/2x with a higher high exhaustion gap between the second and third (three phase) fractal series of 3/6/6 days :: x/2x/2x with a higher high exhaustion gap between day 1 and day 2 of the 6 day subfractal two and a higher high exhaustion gap between day 2 and day 3 of the final 6 day subfractal 3.

The peak of bond market interest rates is within a few weeks of the final lower lower high of equity valuations before the nonlinear October 2023 crash devaluation.. Money exiting from equities will drive interest rates cascadingly lower and ultimately lower than the April 2021 1.17% low.

The projected major self-assembly major quantum interim fractal low for global equities is 31 October 2023.

Based on the Bank of the Shanghai monthly, weekly and daily quantum fractal patterns, the projected major interim fractal low for global equities, commodities and cryptocurrencies is 31 October 2023 and final low Jan-March 2025.

For the Wilshire composed from its 18 August 2023 low, the current working fractal model is (2) sequential 3-phase Lammert fractal decay series of 6/12/12 days ending 27 September 2023 followed by and starting on 27 September 2023, a 5/12/10 day 3-phase crash fractal decay series ending 31 October 2023. The final lower low is expected September October 2024.

Money exiting the collapsing US stock market will drive US Bond interest rates cascadingly to lower lows and eventually lower than the April 2021 1.17% low.

Update 22 October 2023:

The peak fractal growth for US 10 year Notes and 30 year Bonds was previously projected for 6 October 2023 but empirically reached a higher peak on 19 October 2023. With US equities reaching a 13 March 2023 11/22 week and 52/104 day subfractal (1) and subfractal (2) lower high valuation and a March 2020 8/18/20 month lower high valuation before the 5/12/3 of 10 day fractal collapse to 31 October 2023, what is the fractal growth of interest rates of US Notes and Bonds (an exact inversion of previously purchased debt valuation worth) since the Covid low interest rate valuation in March 2020?

Qualitatively after massive Covid money creation and near zero interest rate debt created consumer inflation, central banks have, countervailingly, raised interest rates.

The monthly fractal blow-off growth in long term US sovereign interest rates has occurred in two monthly fractal series as depicted below: 7/16/17 months :: x/2-2.5x/2-2.5x followed by 2/4/3 months :: x/2x/1.5x. A final peak 1.5x growth, ie, 3months can be an interpolated part of a larger 3-phase x/2x/2x-2.5x fractal decay series or part of a 4-phase x/2x/2-2.5/1.6x series.

The last 2/4/3 month fractal series in this fractal growth progression can be observed on a daily fractal basis as 21/52/32 days : x/2.5x/1.5x followed by 14/21 days ::x/1.5x with a peak 10 year Note interest rate on 19 October 2023. see below.

The 14/21 day :: x/1.5x peak interest rate valuation then collapses as global money – from the 13 March 2023 22 week and 1994 30+ year subfractal (2)’s 2x-2.5x US windows of nonlinear collapsing valuation- enters the US sovereign debt market and drives interest rates lower. The 14/21 day :: x/1.5x becomes an interpolated part of a 3-phase 14/29-35/28-35 day decay series or part of a 4-phase 14/29-35/28-35/22 day decay series.

Added 23 October 2023 809PM EST:

On a four hour unit fractal basis, a 8/18/20 month Wilshire and Global crash low will occur in the afternoon of 31 October 2023 with a lower low in Sept-Oct 2024. (see graph below)

27 September 2023 Wilshire 4-hour unit 3-phase fractal decay series 10/22/20 units

0930 EST 27 September to 1330 EST 3 October 10 units

1330 EST 3 October to 0930 EST 18 October 22 units

0930 EST 18 October to 1330 EST 31 October 20 units

At the close of today the 18-31 October series is 4/5 of 9/9 4-hour units.

Subscribe to:

Posts (Atom)